1. Pets at Home Reports Slight Revenue Decline

The UK’s Pets at Home Group has reported a minor decline in revenue for the third quarter, citing weak demand for accessories such as collars, leashes, and pet bedding. The company, however, remains optimistic and has not adjusted its annual profit forecasts. This dip comes amidst rising competition and potential shifts in consumer spending priorities.

While food and healthcare products for pets remain strong performers, the decreased demand for accessories may signal a shift toward more essential spending by pet owners due to broader economic challenges. This development serves as a reminder for businesses to closely monitor consumer trends and adapt to changing priorities.

2. Rising Costs in Veterinary Care Linked to Industry Consolidation

A new report highlights growing concerns about rising veterinary costs, which are now being tied to increased consolidation within the industry. Larger companies and private equity firms acquiring veterinary clinics have led to reduced competition, leaving pet owners with fewer affordable options for care.

This trend is particularly impactful for owners who rely on regular treatments and vaccinations. As a result, many are reevaluating their budgets, potentially leading to increased demand for preventative care products and over-the-counter pet healthcare supplies.

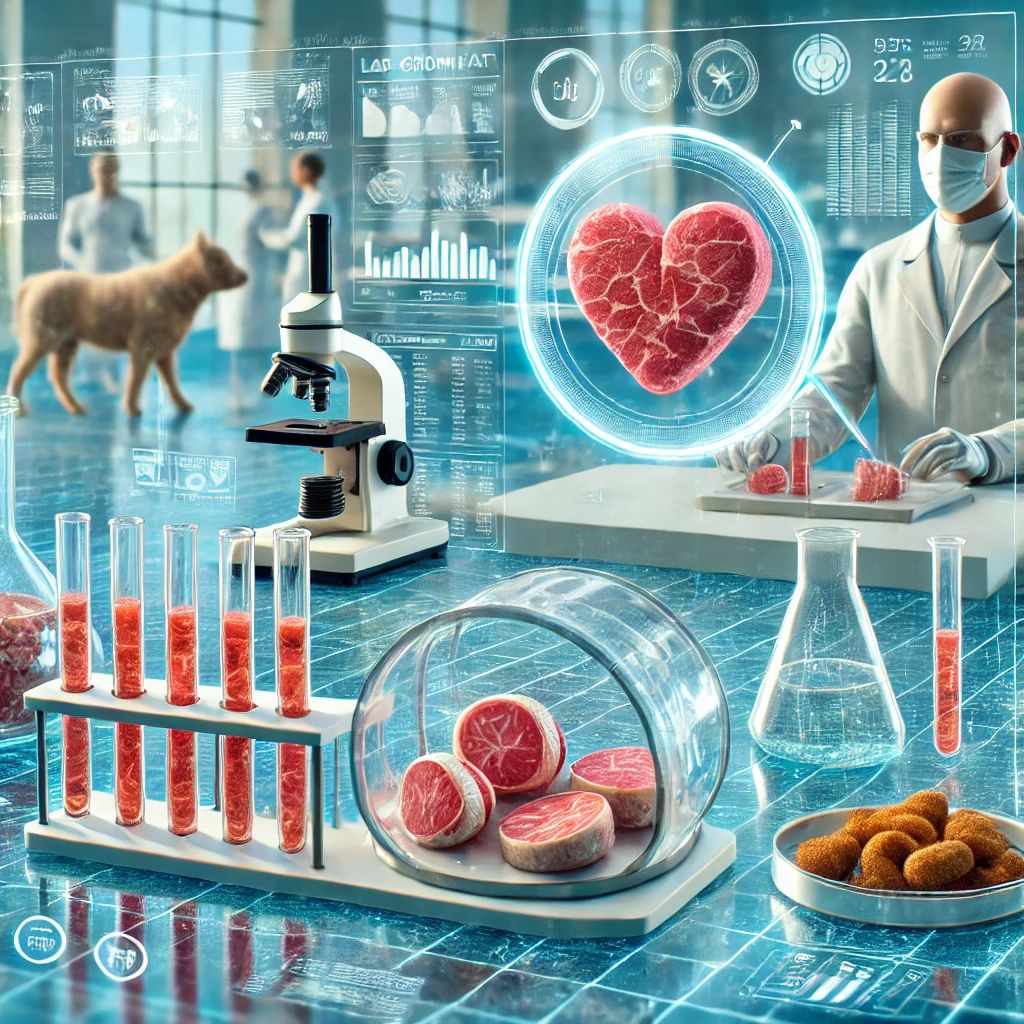

3. UK Approves Lab-Grown Meat for Pet Food

In a groundbreaking move, the UK government has approved the use of lab-grown meat in pet food. This innovative approach aims to address the environmental and ethical concerns associated with traditional meat production, offering a sustainable alternative for environmentally conscious pet owners.

This marks a significant milestone in the pet food industry. While lab-grown meat is still in its early stages, it has the potential to revolutionize how pet food is produced and marketed. As production scales, it could lead to more affordable and eco-friendly options in pet nutrition.

4. Emergence of ‘Pet Tech’ Products Amid Rising Ownership Costs

The global pet care market is embracing technology, with products like fitness trackers, automatic feeders, and interactive toys growing in popularity. These innovations aim to address some of the challenges and costs associated with pet ownership.

For example, automatic feeders help pet owners save time while ensuring consistent feeding schedules, and fitness trackers enable monitoring of a pet’s activity levels and health. While these products can be highly beneficial, experts caution that owners should not substitute human interaction with technological solutions entirely.

5. Surge in UK Sales of Seasonal Pet Treats and Toys

Pet owners in the UK are increasingly splurging on festive treats and toys for their furry companions. During the most recent holiday season, some retailers reported up to a 964% increase in sales for seasonal items, including Christmas-themed pet outfits, gourmet treats, and novelty toys.

This trend reflects the growing “humanization” of pets, as owners treat their animals more like family members. The demand for specialty and festive items presents a massive opportunity for pet supply retailers to capitalize on this emotional connection between pets and their humans.

Bringing It All Together

The pet supply industry is undergoing significant change, from sustainability initiatives to emerging technologies. Whether you’re a pet owner, industry professional, or enthusiast, staying updated on these trends is key to understanding the evolving dynamics of the market.

What do you think about these trends? Share your thoughts in the comments below!